Research themes

Our research spans six linked themes, with a strong focus on enabling positive societal change.

From aerospace engineering research to the study of how structures can cope in extreme environments, the scale of our research is vast and our Department houses a depth of diverse expertise.

Explore our broad research themes below, plus the various sub-areas of expertise in which our researchers specialise.

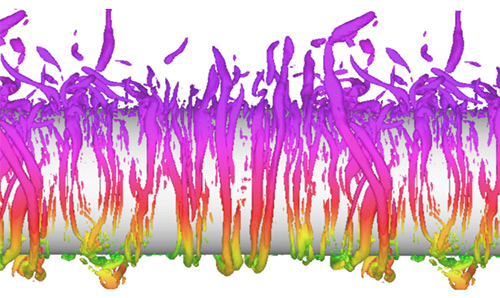

Aerospace engineering

Research focused on advances in aerodynamics to improve autonomous airborne systems.

Innovative manufacturing

Research focused on enabling society to maximise the value of the digitalisation of manufacturing processes.

Modelling and simulation

Interdisciplinary research aiming to address computational modelling at multiple scales.

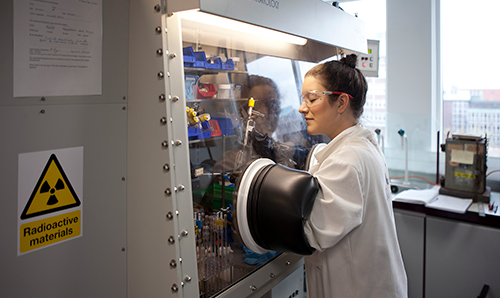

Nuclear engineering

Research to enable the safe operation of current nuclear power stations, with a focus on the future as well.